SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PROXY STATEMENT

Exchange Act of 1934 (Amendment No. )

![[MISSING IMAGE: lg_wattswater-pn.jpg]](https://capedge.com/proxy/PRE 14A/0001104659-23-033598/lg_wattswater-pn.jpg)

March 29, 2021

Chief Executive Officer, President

and Chairperson of the Board

| ||

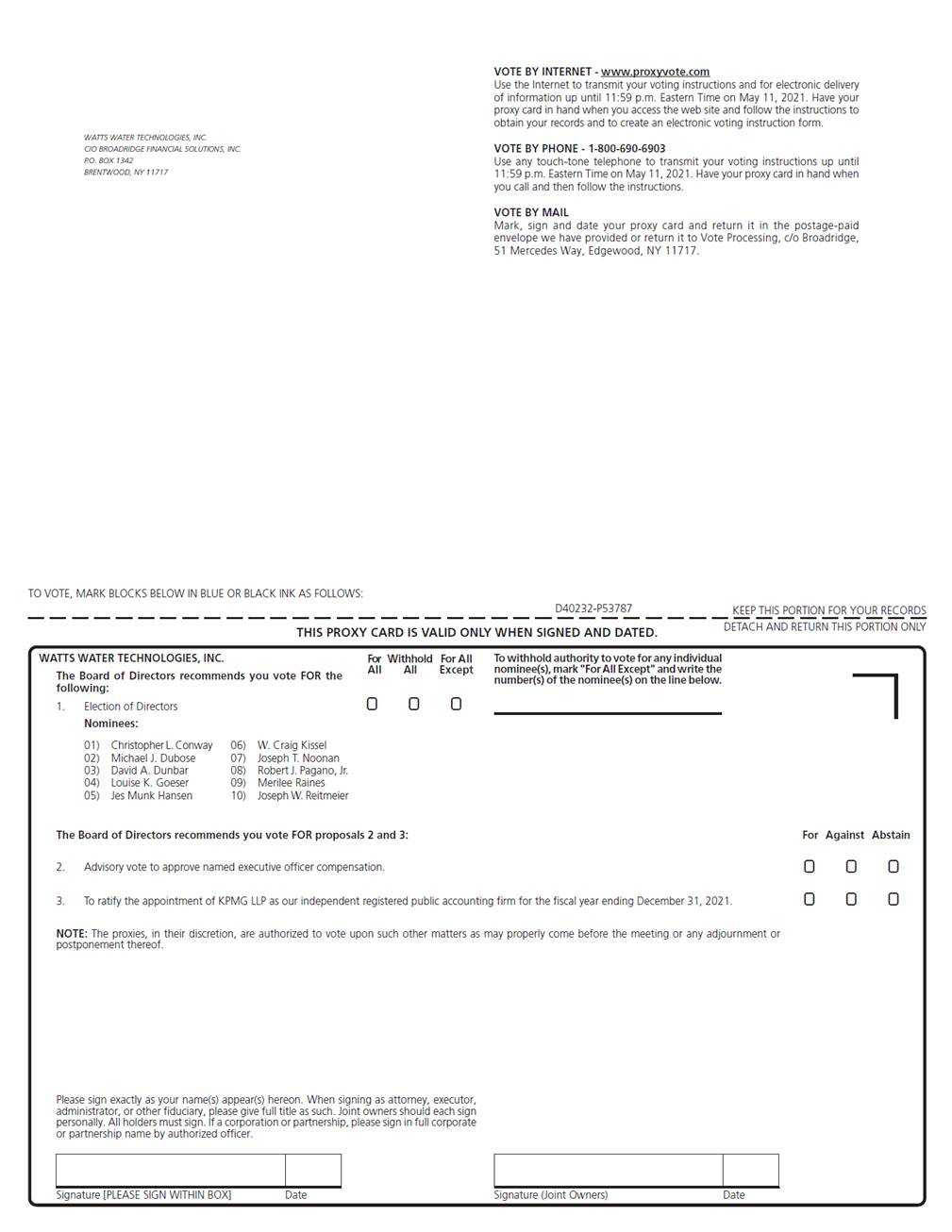

17, 2023 2023. If any other matters properly come before the Annual Meeting, it is the intention of the persons named in the enclosed form of proxy to vote the shares they represent as the Board of Directors recommends.12, 2021

Watts Water Technologies, Inc.20212023 Annual Meeting of Stockholders of Watts Water Technologies, Inc., a Delaware corporation, will be held at our principal executive offices located at 815 Chestnut Street, North Andover, Massachusetts 01845, on Wednesday, May 12, 2021,17, 2023, at 9:00 a.m., local time, for the following purposes:tennine directors named in the proxy statement to our Board of Directors, each to hold office until our 20222024 Annual Meeting of Stockholders and until such director'sdirector’s successor is duly elected and qualified;3.2021.18, 202122, 2023 are entitled to notice of and to vote at the Annual Meeting or any continuation, adjournment or postponement thereof.

KENNETH R. LEPAGEBy Order of the Board of Directors![]()

KENNETH R. LEPAGEGeneral Counsel,Chief Human Resources Officerand Secretary

General Counsel,

Chief Sustainability Officer

and SecretaryMarch 29, 2021

[ •], 2023

| | | | Page | | |||

| | | | | 1 | | | |

| | | | | 1 | | | |

| | | | | 1 | | | |

| | | | | 1 | | | |

| | | | | 2 | | | |

| | | | | | | ||

| | | | | | | ||

| | | | | | | ||

| | | | | | | ||

| | | | | 9 | | | |

| | | | | 11 | | | |

| | | | | 11 | | | |

| | | | | 11 | | | |

| | | | | | | ||

| | | | | | | ||

| | | | | | | ||

| | | | | | | ||

| | | | | | | ||

| | | | | | | ||

| | | | | | | ||

| | | | | | | ||

| | | | | | | ||

| | | | | | | ||

| | | | | | | ||

| | | | | | | ||

| | | | | | | ||

| | | | | | | ||

| | | | | | | ||

Overview | | | | | | | |

| | | | | | | ||

| | | | | | | ||

| | | | | 33

| | ||

| | | | | | | ||

| | | | | 41 | | | |

| | | | | 41 | | | |

| | | | | 41 | | | |

| | | | | 42 | | | |

| | | | | 43 | | | |

| | | | | 43 | | | |

| | | | | 44 | | | |

| | | | | 44 | | | |

| | | | | 47 | | | |

| | | | | 48 | | | |

| | | | | 49 | | | |

| | | | | 50 | | | |

| | | | | 51 | | | |

| | | | | 54 | | | |

| | | | | | | ||

| | | | | | | ||

| | | | | | | ||

| | | | | 60 | | | |

| | | | | 60 | | | |

| | | | | | | ||

May

17, 2023

| | INFORMATION ABOUT THE ANNUAL MEETING | |

| Information About this Proxy Statement | |

17, 2023

| Information About Voting | |

| Quorum; Required Votes; Abstentions and Broker Non-Votes | |

firm, even if the nominee holder does not receive voting instructions from the beneficial owners, but will not have discretionary authority to vote on the election of directors, or the approval of our named executive officer compensation.

compensation, the frequency of future advisory votes to approve our named executive officer compensation, the amendment to our Certificate of Incorporation or any other proposals submitted for approval at the Annual Meeting.

| | PROPOSAL 1 ELECTION OF DIRECTORS | |

| | |||

![[MISSING IMAGE: ph_chirsconway-bw.jpg]](https://capedge.com/proxy/PRE 14A/0001104659-23-033598/ph_chirsconway-bw.jpg) | | | |

| Christopher L. Conway Age: 67 Director Since: 2015 Mr. Conway was President, Chief Executive Officer and Chairperson of the Board of CLARCOR Inc. from December 2011 until it was acquired in February 2017. Mr. Conway is now retired. Mr. Conway originally joined CLARCOR in 2006 and served in several senior management roles prior to becoming President and Chief Executive Officer, including Chief Operating Officer, President of | |

| | ![[MISSING IMAGE: ph_michaeldubose-bw.jpg]](https://capedge.com/proxy/PRE 14A/0001104659-23-033598/ph_michaeldubose-bw.jpg) | | |

| Michael J. Dubose Age: 67 Director since: 2020 Mr. Dubose has served as President of the Fisher Healthcare Division of Thermo Fisher Scientific Inc. since March 2019. Thermo Fisher Scientific engages in the provision of analytical instruments, equipment, reagents and consumables, software and services for research, analysis, discovery, and diagnostics. Mr. Dubose previously served as Vice President of National Accounts and Cross Border Business Globally for W.W. Grainger, Inc. from 2010 to March 2019. W. W. Grainger is a leading broad line supplier of maintenance, repair and operating (MRO) products, with operations primarily in North America, Japan and Europe. Prior to this position, he served as a Regional Vice President of Staples, Inc. from 2008 to 2010. Prior to 2008, Mr. Dubose held senior management positions with Corporate Express Inc., Alliant Foodservice Inc. and Baxter International Inc. | |

| | ![[MISSING IMAGE: ph_dunbar-bw.jpg]](https://capedge.com/proxy/PRE 14A/0001104659-23-033598/ph_dunbar-bw.jpg) | | |

| David A. Dunbar Age: 61 Director since: 2017 Mr. Dunbar has served as President, Chief Executive Officer and a member of the | |

| | ![[MISSING IMAGE: ph_louisegoeser-bw.jpg]](https://capedge.com/proxy/PRE 14A/0001104659-23-033598/ph_louisegoeser-bw.jpg) | | |

| Louise K. Goeser Age: 69 Director since: 2018 Ms. Goeser served as President and Chief Executive Officer of Grupo Siemens S.A. de C.V. from March 2009 until her retirement in May 2018. In this position, Ms. Goeser was responsible for Siemens Mesoamérica, which is the Mexican, Central American and Caribbean unit of multinational Siemens AG, a global engineering company operating in the industrial, energy and healthcare sectors. Ms. Goeser previously served as President and Chief Executive Officer of Ford of Mexico from January 2005 to November 2008. Prior to this position, she served as Vice President, Global Quality for Ford Motor Company from 1999 to 2005. Prior to 1999, Ms. Goeser served as General Manager, Refrigeration and Vice President, Corporate Quality at Whirlpool Corporation and held various leadership positions with Westinghouse Electric Corporation. Ms. Goeser has served as a member of the | |

| | ![[MISSING IMAGE: ph_kissel-bwlr.jpg]](https://capedge.com/proxy/PRE 14A/0001104659-23-033598/ph_kissel-bwlr.jpg) | | |

| W. Craig Kissel Age: 72 Director since: 2011 Mr. | ||

| |

| | ![[MISSING IMAGE: ph_joenoonan-bw.jpg]](https://capedge.com/proxy/PRE 14A/0001104659-23-033598/ph_joenoonan-bw.jpg) | | |

| Joseph T. Noonan Age: 41 Director since: 2013 Mr. Noonan is currently an angel investor and advisor to consumer, software and technology-enabled companies. Mr. Noonan previously served as Founder and Chief Executive Officer of Linger Home, Inc., a direct-to-consumer home textile brand, from August 2018 to January 2020. From November 2013 to January 2018, Mr. Noonan served as Chief Executive Officer of Homespun Design, Inc., an online marketplace for American-made furniture and home accents. Mr. Noonan previously worked as an independent digital strategy consultant from November 2012 to November 2013. Mr. Noonan was employed by Wayfair LLC from April 2008 to November 2012. During his time at Wayfair, Mr. Noonan served as Senior Director of Wayfair International from June 2011 to November 2012, Director of Category Management and Merchandising from February 2009 to June 2011 and Manager of | |

| | ![[MISSING IMAGE: ph_bobpagano-bw.jpg]](https://capedge.com/proxy/PRE 14A/0001104659-23-033598/ph_bobpagano-bw.jpg) | | |

| Robert J. Pagano, Jr. Age: 60 Director since: 2014 Mr. Pagano has served as Chief Executive Officer and President of our Company since May | |

| | ![[MISSING IMAGE: ph_raines-bwlr.jpg]](https://capedge.com/proxy/PRE 14A/0001104659-23-033598/ph_raines-bwlr.jpg) | | |

| Merilee Raines Age: 67 Director since: 2011 Ms. Raines served as Chief Financial Officer of IDEXX Laboratories, Inc. from October 2003 until her retirement in May 2013. Ms. Raines also served as Executive Vice President of IDEXX from July 2012 until her retirement in May 2013. Prior to becoming Chief Financial Officer, Ms. Raines held several management positions with IDEXX, including Corporate Vice President of Finance, Vice President of Finance and Treasurer, | |

| | ![[MISSING IMAGE: ph_reitmeier-bw.jpg]](https://capedge.com/proxy/PRE 14A/0001104659-23-033598/ph_reitmeier-bw.jpg) | | |

| Joseph W. Reitmeier Age: 58 Director since: 2016 Mr. Reitmeier has served as Executive Vice President & Chief Financial Officer of Lennox International Inc. since July 2012. Mr. Reitmeier served as Vice President of Finance for the LII Commercial business segment of Lennox International from 2007 to July 2012 and as Director of Internal Audit from 2005 to 2007. Lennox International is a leading global provider of climate control solutions, and it designs, manufactures and markets a broad range of products for the heating, ventilation, air conditioning and refrigeration markets. Before joining Lennox International, Mr. Reitmeier held financial leadership roles at Cummins Inc. and PolyOne Corporation. | |

| |

2020,2022, our Chief Executive Officer, Robert J. Pagano, Jr., was the only member of our Board of Directors who was an employee of Watts, and he did not receive any additional compensation for his service as a director. Our current compensation arrangements for non-employee directors were set effective as of the firstsecond quarter of 2019,2022, informed by a comprehensive competitive analysis of non-employee director compensation performed for the Compensation Committee by its independent compensation consultant,

| | Annual cash retainer: | | | | $ | 85,000 | | |

| | Additional annual cash retainer for the Lead Independent Director: | | | | $ | 25,000 | | |

| | Additional annual cash retainer for the Chairperson of the Audit Committee: | | | | $ | 20,000 | | |

| | Additional annual cash retainer for the Chairperson of the Compensation Committee: | | | | $ | 15,000 | | |

| | Additional annual cash retainer for the Chairperson of the Governance and Sustainability Committee: | | | | $ | 12,500 | | |

| | Value of annual grant of class A common stock: | | | | $ | 130,000 | | |

Annual cash retainer: | $ | 75,000 | ||

Additional annual cash retainer for the Chairperson of the Board of Directors: | $ | 90,000 | ||

Additional annual cash retainer for the Chairperson of the Audit Committee: | $ | 20,000 | ||

Additional annual cash retainer for the Chairperson of the Compensation Committee: | $ | 15,000 | ||

Additional annual cash retainer for the Chairperson of the Nominating and Corporate Governance Committee: | $ | 12,500 | ||

Value of annual grant of class A common stock: | $ | 110,000 |

We also reimburse non-employee directors for reasonable out-of-pocket expenses incurred in connection with attending Board and committee meetings. Non-employee directors do not receive any additional compensation for attendance at Board or committee meetings.

During 2020, we proactively took aggressive cost reduction actions starting late in the first quarter of 2020 to address the anticipated impact of the COVID-19 pandemic on our business. As part of our cost reduction actions, the Board approved a voluntary 25% reduction in the amount of the cash retainer for non-employee directors, including the additional retainers paid to the chairperson of the board and committee chairpersons, effective from the 2020 Annual Meeting until the 2021 Annual Meeting. Accordingly, the actual amounts paid to our Board members in 2020 were less than the amounts indicated above.

Our Board typically approves grants of stock awards to non-employee directors at its first quarterly meeting following the election of directors at our Annual Meeting of Stockholders. On July 27, 2020,August 1, 2022, we granted 1,3591,019 shares of class A common stock to each of Messrs. Conway, Dubose, Dunbar, Hansen, Kissel, Noonan and Reitmeier and Mses. Goeser and Raines. Such awards were not subject to vesting or any other conditions or restrictions. Under our Third Amended and Restated 2004 Stock Incentive Plan (the “2004 Stock Incentive Plan”), the maximum aggregate number of shares of class A common stock with respect to one or more awards that may be granted to a non-employee director during any one calendar year is 100,000. For the July 27, 2020August 1, 2022 grants, our Board determined the number of shares to be awarded to our non-employee directors using a three-monththirty-days trailing average stock price, which resulted in a grant date fair value that was slightly morehigher than the target value of the annual stock grant to non-employee directors. This represented a change from the Board's practice in prior years of using a twelve-month trailing average stock price to determine the number of shares to be awarded. In February 2019, the Compensation Committee reevaluated its practice of using a twelve-month trailing average stock price to determine the number of shares underlying equity awards granted to employees and directors. This review included a consideration of current industry practices and advice and guidance from Pearl Meyer. Based on this review, the Compensation Committee decided that beginning in 2020 it would use a three-month trailing average stock price to determine the number of shares underlying equity awards to non-employee directors. Non-employee directors who are first elected to our Board other than at an annual meeting of stockholders receive an award of shares prorated based on the number of quarterly meetings remaining between their election and the expected date of our next annual meeting of stockholders. Mr. Dubose was elected to the Board on December 8, 2020 and received an award of 525 shares of class A common stock, which represented one-half of the value of the annual grant of stock awarded to non-employee Board members for the 2020-2021 term using a three-month trailing average stock price.

| | Name | | | Fees Earned or Paid in Cash ($) | | | Stock Awards ($)(1) | | | Total ($) | | |||||||||

| | Christopher L. Conway | | | | | 95,000 | | | | | | 141,835 | | | | | | 236,835 | | |

| | Michael J. Dubose | | | | | 80,000 | | | | | | 141,835 | | | | | | 221,835 | | |

| | David A. Dunbar | | | | | 80,000 | | | | | | 141,835 | | | | | | 221,835 | | |

| | Louise K. Goeser | | | | | 80,000 | | | | | | 141,835 | | | | | | 221,835 | | |

| | W. Craig Kissel | | | | | 133,750 | | | | | | 141,835 | | | | | | 275,585 | | |

| | Joseph T. Noonan | | | | | 80,000 | | | | | | 141,835 | | | | | | 221,835 | | |

| | Merilee Raines | | | | | 100,000 | | | | | | 141,835 | | | | | | 241,835 | | |

| | Joseph W. Reitmeier | | | | | 80,000 | | | | | | 141,835 | | | | | | 221,835 | | |

| | | | | | | | | | | |

Name | Fees Earned or Paid in Cash($) | Stock Awards($)(1) | Total($) | |||||||

| | | | | | | | | | | |

Christopher L. Conway | 67,500 | 115,936 | 183,436 | |||||||

Michael J. Dubose(2) | | — | | 62,071 | | 62,071 | ||||

David A. Dunbar | 56,250 | 115,936 | 172,186 | |||||||

Louise K. Goeser | | 56,250 | | 115,936 | | 172,186 | ||||

Jes Munk Hansen | 56,250 | 115,936 | 172,186 | |||||||

W. Craig Kissel | | 133,125 | | 115,936 | | 249,061 | ||||

Joseph T. Noonan | 56,250 | 115,936 | 172,186 | |||||||

Merilee Raines | | 71,250 | | 115,936 | | 187,186 | ||||

Joseph W. Reitmeier | 56,250 | 115,936 | 172,186 | |||||||

| | | | | | | | | | | |

(1)- The amounts in this column reflect the grant date fair value of the stock awards granted during

20202022 determined in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718. A discussion of the assumptions used in calculating the amounts in this column may be found in Note 13 to our audited consolidated financial statements for the year ended December 31,20202022 included in our Annual Report on Form 10-K filed with the SEC on February18, 2021.21, 2023. The amounts reflected in this column for Messrs. Conway and Reitmeier andMses. Goeser andMs. Raines were deferred under our non-employee director stock deferral program described above. (2)Mr. Dubose was elected as a memberNone of ourBoard onnon-employee directors held any unvested stock awards or option awards as of December8, 2020 and received the first quarterly installment of his cash retainer in January 2021.

| | CORPORATE GOVERNANCE | |

Members of our Board keep informed about our business through discussions with our Chief Executive Officer and other members of our senior management team, by reviewing materials provided to them on a regular basis and in preparation for Board and committee meetings and by participating in meetings of the Board and its committees. We regularly review key portions of our business with the Board, and we introduce our executives to the Board so that the Board can become familiar with ourofficers'officers’ performance and compensation. Our Board oversees the development of fundamental operating, financial and other corporate plans, strategies and objectives, and conducts a year-long process which culminates in Board review and approval each year of a business plan, a capital expenditures budget and other key financial and business objectives. Our Board also oversees our approach to sustainability and corporate social responsibility.

ESG Governance

•Ourcharitable giving.

| | Sustainability Leadership | | | In May 2022, our Board of Directors amended the charter of our Nominating and Corporate Governance Committee to rename it as the Governance and Sustainability Committee and to delegate to the Committee primary responsibility for the oversight of our environmental, social and governance (ESG) efforts and strategy. The Governance and Sustainability Committee reviews the Company’s ESG performance and strategic plans four times a year at its regularly scheduled quarterly meetings and receives additional updates from the Company’s Chief Sustainability Officer as needed. At the management level, our General Counsel and Chief Sustainability Officer, who reports directly to our Chief Executive Officer, has general oversight responsibility for all sustainability matters. Our General Counsel and Chief Sustainability Officer also chairs our global Sustainability Steering Committee, which is made up of senior company leaders and is responsible for formulating our sustainability strategy and overseeing the execution of our ESG initiatives. | |

| | Sustainability Strategy | | | In 2021, we conducted a sustainability materiality assessment with the assistance of an external consultant. The results of that assessment are being used by the Sustainability Steering Committee to identify our key focus areas and from there to build a strategy to address the material ESG topics identified by the materiality assessment. | |

| | Environmental Stewardship | | | We have made substantial progress in minimizing the environmental impact of our operations. Recent initiatives have resulted in a reduction in our global water consumption and our greenhouse gas emissions, including through the implementation of smart monitoring systems in many of our high water use facilities to promote early leak and surge detection and investments in various energy reduction projects. With respect to our product handprint, we provide an extensive portfolio of products, components and systems that conserve water, save energy, reduce waste and preserve water quality and safety. In addition, our goal is to embed sustainability throughout the lifecycle of our products to create safe, efficient, long-lasting products made with high-recycling-value materials wherever possible. | |

| | Social Responsibility | | | We are committed to creating both economic and social value and we strive to have a positive impact on our global community. During 2022, we supported those in need through donations of money and products to several non-profit charitable organizations and through the volunteer efforts of our employees. One example was our ongoing partnership with the Planet Water Foundation. During 2022, we worked with Planet Water to fund the construction of six AquaTowers and AquaSan systems, which provide clean, safe drinking water for up to 10,800 people in Cambodia, India, Mexico, the Philippines and Indonesia. | |

| | Governance, Business Ethics & Compliance | | | We believe that good corporate governance and an environment of high ethical standards are important for us to achieve business success and to create value for our stockholders. Our Board is committed to high governance standards and continually works to improve them. We periodically review our corporate governance policies and practices and compare them to those suggested by various authorities on corporate governance and employed by other public companies and consider changes to our corporate governance policies and practices in light of such guidance and interpretations. We have adopted a Code of Business Conduct applicable to all officers, employees and Board members worldwide that serves as the foundation for our ethics and compliance program, and drives policy development, training initiatives, and reinforcement of our values throughout the global organization. | |

| | Human Capital | | | Employee safety is one of our highest priorities and we strive for zero hazards and zero injuries by educating and training employees on safety best practices through awareness campaigns and related safety initiatives. We are also committed to promoting an inclusive, diverse and engaging workplace. In 2022, 80% of our employee population participated in a pulse survey to gain feedback on a core set of engagement items and performance drivers aligned to our business priorities. Reflecting our commitment to diversity, equity and inclusion, we recently conducted a global diversity, equity and inclusion employee survey, enhanced our talent recruitment processes with new hiring standards for diversity, engaged with five historically Black colleges and universities to attract and recruit diverse professionals, deployed training and development programs on unconscious bias, inclusive leadership and communicating about culturally sensitive issues, and formed several employee resource groups for diverse employees. | |

| | Recognition | | | In 2022, we were recognized for the fourth year in a row as one of Newsweek’s Most Responsible Companies. We were also promoted to the “low-risk” category by Sustainalytics in their annual ESG Risk Rating Report. | |

Tableis not included as part of, Contents

•Our commitment to addressing business-related sustainability while delivering stockholder value is best illustratedor incorporated byour actions, progress and the associated recognition we have received. In 2020, we published our 4thannual sustainability report and for the second consecutive year we were recognized as one of America's "Most Responsible Companies" by Newsweek Magazine.•We have incorporated ESG metrics in the individual performance goals for our executive officers and our senior business leaders.

Governance Committee is primarily responsible for oversight of governance matters, the Compensation Committee is responsible for oversight of human capital issues and the Audit Committee is responsible for oversight of our corporate ethics and compliance program.

reference into, this proxy statement.

We separate

strategy to stockholders, customers, employees and the public in a single voice.

Under our Corporate Governance Guidelines, we require that at least a majority of the members of our Board meet the independence requirements of the NYSE. Under NYSE rules, a director qualifies as "independent"“independent” if the Board affirmatively determines that the director has no material relationship with the company of which he or she serves as a director. The Board is required to consider broadly all relevant facts and circumstances in making an independence determination. Material relationships can include commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships. The NominatingGovernance and Corporate GovernanceSustainability Committee annually evaluates the independence of each non-employee director nominee and makes recommendations to the Board. In making its recommendations, the NominatingGovernance and Corporate GovernanceSustainability Committee applies NYSE rules to determine a director'sdirector’s independence and evaluates any other business, legal, accounting or family relationships between all non-employee director nominees and us.

| | ||||

Audit Committee The Board has made a determination that each of the members of the Audit Committee satisfies the independence requirements of the NYSE as well as Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act. In addition, the Board has determined that each of Ms. Raines and Messrs. Dunbar and Reitmeier is an ➤ the integrity of our consolidated financial statements; ➤ our compliance with legal and regulatory requirements; ➤ the qualifications, independence and performance of our independent registered public accounting firm; ➤ the performance of our internal audit function; and ➤ the effectiveness of our internal control over financial reporting. The Audit ➤ the appointment and evaluation of our independent registered public accounting firm; ➤ the review of ➤ the review of management’s approach to information security assessment and risk mitigation; ➤ the review of the annual independent audit of our consolidated financial statements; ➤ the review of our Code of Business Conduct; ➤ the establishment and oversight of ➤ the oversight of other compliance matters. The Audit Committee holds one regularly scheduled meeting each quarter and schedules additional meetings as often as necessary in order to perform its duties and responsibilities. During | ||||

| | | COMMITTEE MEMBERS Merilee Raines, Chairperson David A. Dunbar Joseph W. Reitmeier | |

Governance and The Governance

➤ overseeing the Company’s overall approach to sustainability and corporate citizenship; ➤ identifying individuals qualified to become Board members, consistent with criteria approved by the Board, and recommending that the Board select the director nominees for election at each annual meeting of stockholders; ➤ periodically reviewing our Corporate Governance Guidelines and recommending any changes thereto, overseeing the evaluation of the Board, and approving related person transactions; and ➤ monitoring our policies and practices for the development and succession of senior management. The | | | COMMITTEE MEMBERS W. Craig Kissel, Chairperson Christopher L. Conway Michael J. Dubose David A. Dunbar Louise K. Goeser Merilee Raines Joseph W. Reitmeier |

| |

| | ||||

Compensation Committee Our Compensation Committee is responsible for shaping the principles, strategies and compensation philosophy that guide the design and implementation of our employee compensation programs and arrangements. Its primary responsibilities are to: ➤ evaluate the performance of our Chief Executive Officer and, either as a committee or together with the independent members of our Board of Directors, determine the compensation of our Chief Executive Officer; ➤ review and approve, or recommend to the Board, the compensation of our other executive officers; ➤ approve annual performance bonus targets and objectives and the annual bonus amounts paid to our executive officers under our Executive Officer Incentive Bonus Plan; ➤ administer our stock incentive plans and approve all stock awards granted to our executive officers under our 2004 Stock Incentive Plan and the participants in our Management Stock Purchase Plan; ➤ review and submit recommendations to our Board of Directors on compensation for non-employee directors; and ➤ review and discuss with management the Compensation Discussion and Analysis to be included in the proxy statement. | | | COMMITTEE MEMBERS Christopher L. Conway, Chairperson Michael J. Dubose Louise K. Goeser W. Craig Kissel | |

In October 2020, a third-party search firm introduced the Board to Michael J. Dubose. After an extensive screening and interview process, the Board appointed Mr. Dubose to the Board on December 8, 2020. Mr. Dubose is standing for election by our stockholders as a member of our Board of Directors for the first time at the 2021 Annual Meeting.

”

strategy. Our Board reviewed and evaluated these experiences, qualifications, attributes and skills in nominating our current directors for reelection and each contributed to the conclusion that each director should serve as a member of our Board. The table does not encompass all the experience, qualifications, attributes or skills of our directors, and the fact that a particular experience, qualification, attribute or skill is not listed does not mean that a director does not possess it. In addition, the absence of a particular experience, qualification, attribute or skill does not mean that the director in questionsquestion is unable to contribute to the decision-making process in that area. The type and degree of experience, qualification, attribute and skill listed below may vary among members of the Board.

| | Qualifications, Attributes & Skills | | | Conway | | | |||||||||||||||||||||||||||||||||||||

| Michael J. Dubose | |||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Dunbar | | | Goeser | | | W. Craig Kissel | | | Joseph T. Noonan | | | Robert J. Pagano, Jr. | | | Merilee Raines | | | Joseph W. Reitmeier | | ||||||||||||||||||||||

| | Operational Experience developing and implementing operating plans and business strategy | | ✓ | | | ✓ | | | ✓ | | | ✓ | | | ✓ | | | ✓ | | ||||||||||||||||||||||||

| | Industry Background Experience in industries, end-markets and growth segments that Watts serves, such as fluid solutions, water quality and conditioning, and heating and hot water solutions | | ✓ | | ✓ | | | | | | | ✓ | | | | ✓ | | | | | | ✓ | | ||||||||||||||||||||

| | Finance/Capital Allocation Knowledge of finance or financial reporting; experience with debt and capital market transactions | | | ✓ | | | ✓ | | | | ✓ | | | | | ✓ | | | ✓ | | | ✓ | | | ✓ | | |||||||||||||||||

| | Mergers & Acquisitions Experience managing, negotiating and integrating mergers with or acquisitions of other companies | | ✓ | | | ✓ | | ✓ | | | | | ✓ | | | ✓ | | | ✓ | | |||||||||||||||||||||||

| | Supply Chain/Logistics Experience in supply chain management encompassing the planning and management of all activities involved in sourcing and procurement | | | ✓ | | | ✓ | | | ✓ | | | | | | | | | | | ✓ | | | | | | ✓ | | |||||||||||||||

| | Digital/eCommerce Experience implementing digital strategies and/or operating an eCommerce business | | | ✓ | | | ✓ | | ✓ | | | | ✓ | | | ✓ | | | | | | ✓ | | ||||||||||||||||||||

| | Marketing/Sales & Brand Management Experience managing a marketing/sales function and in increasing the perceived value of a product line or brand over time in the market | | | ✓ | | | ✓ | | | ✓ | | | ✓ | | | ✓ | | | | | | ✓ | | | | | | ✓ | | ||||||||||||||

| | Human Resources/Executive Compensation Experience with the recruitment, retention and development of key talent; experience with executive compensation and broad-based incentive planning | | ✓ | | | ✓ | | | ✓ | | | | | | | ✓ | | | | | | ✓ | | ||||||||||||||||||||

| | Senior Leadership Experience Experience serving as the chief executive officer or a senior executive of a large and complex organization | | | | ✓ | | ✓ | | | ✓ | | | ✓ | | | | | | ✓ | | | ✓ | | | ✓ | | |||||||||||||||||

| | Corporate Governance/Public Company Experience Experience serving as a director of another public company; demonstrated understanding of current corporate governance standards and best practices in public companies | | ✓ | | | | ✓ | | | | | ✓ | | | ✓ | | | ✓ | | | ✓ | | |||||||||||||||||||||

| | International Experience Significant exposure to markets and economies outside of the | | ✓ | | | ✓ | | | ✓ | | | ✓ | | | ✓ | | | ✓ | | ||||||||||||||||||||||||

| | Risk Assessment & Risk Management Experience overseeing complex risk management matters | | ✓ | | | | ✓ | | ✓ | | | | | | ✓ | | | ✓ | | | ✓ | | |||||||||||||||||||||

| | Technology/Cyber Security Experience implementing technology strategies and managing/mitigating cyber security risks | | ✓ | | | | ✓ | | ✓ | | | | | | | ✓ | | | | | | ✓ | | ||||||||||||||||||||

| | Government, Regulatory, Public Policy Experience managing complex regulatory matters that are integral to the operations of a business | | | ✓ | | | | | | ✓ | | ✓ | | | | | | | | | ✓ | | | | | | ✓ | | |||||||||||||||

| | Business Ethics/Environmental, Social and Governance (ESG) Experience in ESG matters, social responsibility, sustainability and philanthropy | ||||||||||||||||||||||||||||||||||||||||||

| | | ✓ | | | ✓ | | | ✓ | | | ✓ | | | ✓ | | | | | | | | | | | |

Corporate Governance Sustainability Committee believes that the backgrounds and qualifications of the members of the Board, considered as a group, should provide an appropriate mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities. Our Board has recently prioritizedprioritizes increasing gender and racial diversity among our Board members and has adopted the practice that the search criteria for all Board member search processes include

| | | | | Christopher L. Conway | | | Michael J. Dubose | | | David A. Dunbar | | | Louise K. Goeser | | | W. Craig Kissel | | | Joseph T. Noonan | | | Robert J. Pagano, Jr. | | | Merilee Raines | | | Joseph W. Reitmeier | |

| | Race/Ethnicity | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | African American/Black | | | | | | ✓ | | | | | | | | | | | | | | | | | | | | | | |

| | Asian/Pacific Islander | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | White/Caucasian | | | ✓ | | | | | | ✓ | | | ✓ | | | ✓ | | | ✓ | | | ✓ | | | ✓ | | | ✓ | |

| | Hispanic/Latino | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Native American | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Gender | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Male | | | ✓ | | | ✓ | | | ✓ | | | | | | ✓ | | | ✓ | | | ✓ | | | | | | ✓ | |

| | Female | | | | | | | | | | | | ✓ | | | | | | | | | | | | ✓ | | | | |

| | | | | | | | | | | |

| Gender | Female | Male | ||||||||

| | | | | | | | | | | |

| Number of Directors | | 2 | | 8 | | |||||

| Race/Ethnicity | African American/Black | Asian/Pacific Islander | White/Caucasian | Hispanic/ Latino | Native American | |||||

| Number of Directors | 1 | — | 9 | — | — | |||||

| | | | | | | | | | | |

Compensation Committee Interlocks and Insider Participation

related person transactions that arise between committee meetings, subject to ratification by the committee at its next meeting. Any related person transactions that are ongoing in nature will be reviewed annually.

| | PRINCIPAL STOCKHOLDERS | |

| | Name of Beneficial Owner(1) | | | Number | | | Shares Beneficially Owned(2) | | | Percent of Voting Power | | |||||||||||||||

| | Percent of Class A Common Stock | | | Percent of Class B Common Stock | | |||||||||||||||||||||

| | 5% Stockholders | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Timothy P. Horne | | | | | 5,988,290(3)(4) | | | | | | 18.0 | | | | | | 99.7 | | | | | | 68.3 | | |

| | Walter J. Flowers | | | | | 1,803,710(5) | | | | | | 6.2 | | | | | | 30.3 | | | | | | 0 | | |

| | Daniel W. Horne | | | | | 1,666,970(6) | | | | | | 5.7 | | | | | | 28.0 | | | | | | 0 | | |

| | Deborah Horne | | | | | 1,666,970(6) | | | | | | 5.7 | | | | | | 28.0 | | | | | | 0 | | |

| | Peter W. Horne | | | | | 1,529,770(7) | | | | | | 5.3 | | | | | | 25.4 | | | | | | * | | |

| | BlackRock, Inc. | | | | | 4,286,847(8) | | | | | | 15.7 | | | | | | 0 | | | | | | 4.9 | | |

| | The Vanguard Group | | | | | 2,967,785(9) | | | | | | 10.8 | | | | | | 0 | | | | | | 3.4 | | |

| | Kayne Anderson Rudnick Investment Management LLC | | | | | 2,091,713(10) | | | | | | 7.6 | | | | | | 0 | | | | | | 2.4 | | |

| | Impax Asset Management Group plc | | | | | 1,699,428(11) | | | | | | 6.2 | | | | | | 0 | | | | | | 2.0 | | |

| | Directors and Executive Officers | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Christopher L. Conway | | | | | 11,043(12) | | | | | | * | | | | | | 0 | | | | | | * | | |

| | Andre Dhawan | | | | | 2,608 | | | | | | * | | | | | | 0 | | | | | | * | | |

| | Michael J. Dubose | | | | | 2,008 | | | | | | * | | | | | | 0 | | | | | | * | | |

| | David A. Dunbar | | | | | 7,893 | | | | | | * | | | | | | 0 | | | | | | * | | |

| | Louise K. Goeser | | | | | 6,281(13) | | | | | | * | | | | | | 0 | | | | | | * | | |

| | W. Craig Kissel | | | | | 18,102 | | | | | | * | | | | | | 0 | | | | | | * | | |

| | Kenneth R. Lepage | | | | | 18,938(14) | | | | | | * | | | | | | 0 | | | | | | * | | |

| | Elie A. Melhem | | | | | 11,358(15) | | | | | | * | | | | | | 0 | | | | | | * | | |

| | Joseph T. Noonan | | | | | 24,478(16) | | | | | | * | | | | | | * | | | | | | * | | |

| | Robert J. Pagano, Jr. | | | | | 149,472(17) | | | | | | * | | | | | | 0 | | | | | | * | | |

| | Shashank Patel | | | | | 16,980(18) | | | | | | * | | | | | | 0 | | | | | | * | | |

| | Merilee Raines | | | | | 19,307(19) | | | | | | * | | | | | | 0 | | | | | | * | | |

| | Joseph W. Reitmeier | | | | | 9,781(20) | | | | | | * | | | | | | 0 | | | | | | * | | |

| | All current executive officers and directors (14 persons) | | | | | 300,219(21) | | | | | | 1.1 | | | | | | * | | | | | | * | | |

| | | | | | | | | | | | |

| | | Shares Beneficially Owned(2) | | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Name of Beneficial Owner(1) | Number | Percent of Class A Common Stock | Percent of Class B Common Stock | Percent of Voting Power | |||||||

| | | | | | | | | | | | |

5% Stockholders | | | | ||||||||

Timothy P. Horne | 6,094,290 | (3)(4) | 18.1 | 99.2 | 68.4 | ||||||

Walter J. Flowers | | 1,839,710 | (5) | | 6.3 | | 30.0 | 0 | |||

Daniel W. Horne | 1,666,970 | (6) | 5.7 | 27.2 | 0 | ||||||

Deborah Horne | | 1,666,970 | (6) | | 5.7 | | 27.2 | 0 | |||

Peter W. Horne | 1,563,770 | (7) | 5.4 | 25.5 | * | ||||||

BlackRock, Inc. | | 4,544,633 | (8) | | 16.5 | | 0 | 5.1 | |||

The Vanguard Group | 2,743,703 | (9) | 10.0 | 0 | 3.1 | ||||||

Kayne Anderson Rudnick Investment Management LLC | | 2,326,259 | (10) | | 8.4 | | 0 | 2.6 | |||

Impax Asset Management Group plc | 1,430,255 | (11) | 5.2 | 0 | 1.6 | ||||||

Directors and Executive Officers | | | |

| |||||||

Christopher L. Conway | 9,230 | (12) | * | 0 | * | ||||||

Michael J. Dubose | | 525 | | * | | 0 | * | ||||

David A. Dunbar | 6,080 | * | 0 | * | |||||||

Louise K. Goeser | | 4,468 | (13) | | * | | 0 | * | |||

Jes Munk Hansen | 6,080 | * | 0 | * | |||||||

W. Craig Kissel | | 16,289 | | * | | 0 | * | ||||

Kenneth R. Lepage | 28,867 | (14) | * | 0 | * | ||||||

Elie A. Melhem | | 9,957 | (15) | | * | | 0 | * | |||

Munish Nanda | 20,104 | (16) | * | 0 | * | ||||||

Joseph T. Noonan | | 22,665 | (17) | | * | | * | * | |||

Robert J. Pagano, Jr. | 97,143 | (18) | * | 0 | * | ||||||

Shashank Patel | | 15,061 | (19) | | * | | 0 | * | |||

Merilee Raines | 17,494 | (20) | * | 0 | * | ||||||

Joseph W. Reitmeier | | 7,968 | (21) | | * | | 0 | * | |||

All current executive officers and directors (14 persons) | 261,931 | (22) | 1.0 | * | * | ||||||

| | | | | | | | | | | | |

*- Represents less than 1%

- (1)

of both shall be necessary and sufficient for the validity of any action taken by such trustees and if at any time there is one Successor Trustee, such Successor Trustee'sTrustee’s action shall be necessary and sufficient for the validity of any action taken by such trustee. The 1997 Voting Trust was extended effective as of August 12, 2020 by unanimous agreement of the holders of all the outstanding trust certificates issued under the 1997 Voting Trust agreement for an additional period of five years and will expire on August 26, 2026. The 1997 Voting Trust may be

- (9)

(21)- (20)

| | COMPENSATION DISCUSSION AND ANALYSIS | |

The following Compensation Discussion and Analysis

| | |||||

| Robert J. Pagano, Jr. | | | Chief Executive Officer, President & | | |

| | Shashank Patel | | | Chief Financial Officer | |

| Andre Dhawan | | Chief Operating Officer | | ||

| | Elie A. Melhem | | | President, Asia-Pacific, the Middle East & Africa | |

| | Kenneth R. Lepage | | | General Counsel, Chief | |

Despite

| | | Key Results for 2022 | | |

| | | • Sales of $1.98 billion, an increase of 9% over 2021 • Net Income of $252 million, an increase of 52% over 2021 • Earnings Per Share of $7.48, an increase of 53% over 2021 • Operating Margin of 15.9%, an increase of 270 basis points from 2021 | | |

| | | | |

•We suspended base salary increases for allcustomers to reduce the negative impact they have on the environment. During 2022, we issued a Human Rights Policy aligned with the UN Global Compact, expanded ourexecutive officers for 2020;•Our Chief Executive Officer's base salary was reducedcommitment to water stewardship by25%joining the CEO Water Mandate, improved our Sustainalytics ESG score by 24% (promoting us to the “low risk” category) and we were named by

•In order to further decrease operating expenses and better align with the needs of the business, we reduced our worldwide workforce, including two members of our global leadership team.

These cost reduction efforts enabled us to maintain our 2020 operating margin consistent with prior year levels despite reduced revenues and to continue to invest in our strategic growth initiatives with a heavy focusexecute on our smart and connected strategy increased customer intimacyby investing in IoT (Internet of Things) architecture development, enhancing digital tools used by our customers, including our website, and innovation.investing in new smart and connected enabled product development projects. We introduced twenty new smart and connected enabled product offerings in 2022 that will connect our customers with smart systems, control systems for optimal performance, and conserve critical resources by increasing operability, efficiency and safety. Smart and connected enabled products represented 19% of our consolidated sales in 2022.

focus on our customers, executing on our strategic initiatives, driving new product development, especially in smart and connected enabled products, and promoting sustainability across the spectrum of environmental, social and governance issues.

![[MISSING IMAGE: pc_ceoneo-pn.jpg]](https://capedge.com/proxy/PRE 14A/0001104659-23-033598/pc_ceoneo-pn.jpg)

(1)- Total direct compensation

opportunitymix does not include perquisites or other executive benefits, including retirement and severance benefits, or the value of the discount attributable to the purchase price for restricted stock units under our Management Stock Purchase Plan. (2)Long-Term Incentive ValueFixed compensation consists ofMr. Pagano'sbase salary and variable compensation consists of target annualgrants of performance stock unit awardsincentive anddeferred stock awards based on their grant date fair value as reported in the 2020 Summary Compensation Table below.

(1)Other Named Executive Officers include Messrs. Patel, Nanda, Melhem and Lepage. Total direct compensation opportunity does not include perquisites or other executive benefits, including retirement and severance benefits, or the value of the discount attributable to the purchase price for restricted stock units under our Management Stock Purchase Plan.(2)Long-Term Incentivelong-term incentive value. Long-term incentive value consists of annual grants of performance stock unit awards and deferred stock awards based on their grant date fair value as reported in the20202022 Summary Compensation Table below.

Table Short-term compensation consists of Contents

Other compensation decisions in 2020 reflected our compensation philosophy, as set forth in more detail below. In February 2020, the Compensation Committee approved base salary increases for eachand target annual incentive. Long-term compensation consists of our named executive officers to be effective on April 1, 2020, reflecting a considerationlong-term incentive value. Cash compensation consists of individual and Company performance as well as competitive position relative to market, among other factors, but, as previously discussed, those base salary increases were not implemented due to the impactand target annual incentive. Equity compensation consists of the COVID-19 pandemic.

long-term incentive value.

We will determine the frequency of our future say-on-pay advisory votes after considering the results of the advisory vote on the frequency of future say-on pay-votes included as Proposal No. 3 of this proxy statement.

| | |||||

| Altra Industrial Motion Corporation | A.O. Smith Corporation Barnes Group Inc. Crane Co. Evoqua Water Technologies Corp. | | |||

| EnPro Industries, Inc. | |||||

Franklin Electric Co., Inc. Graco Inc. IDEX Corporation Itron, Inc. | | | ITT Corporation Mueller Industries, Inc. | ||

Mueller Water Products, Inc. | |||||

Pentair plc Zurn Water Solutions Corporation |

In May 2020,2022, the Compensation Committee engaged Pearl Meyer to conduct a comprehensive review of our executive compensation peer group. Pearl Meyer used a rules-based process to evaluate the Company'sCompany’s existing executive compensation peer group and to identify proposed changes to the peer group based on the similarity to Watts of the amount of their annual revenues, profitability, market capitalization and number of employees as well as the similarity of their industry, business models, scope of international operations, industrial classification codes, customers and analyst coverage, while attempting to minimize year-over-year changes in order to foster consistency in the benchmarking approach. Based on its review, Pearl Meyer recommended removing Enerpac Tool Group Corp. (formerly Actuant Corporation) due to the recent significant decrease in its revenueCIRCOR International, Inc. and profitabilityWoodward, Inc. and replace itreplacing them with EvoquaPentair plc and Zurn Water Technologies Corp. due to comparable industry, size and complexity of its business.Solutions Corporation. The Compensation Committee accepted Pearl Meyer'sMeyer’s recommendation and approved replacing Enerpac Tool Group Corp. with Evoqua Water Technologies Corp. and otherwise retaining the existingnew peer group. The resulting executive compensation peer group had median 20192021 annual revenue of approximately $1.83$1.9 billion, compared with our own revenue of approximately $1.60$1.8 billion for the same period. The peer group also had median market capitalization as of December 31, 20192021 of $3.14approximately $4.4 billion, as compared to our market capitalization of approximately $3.38$6.5 billion.

2022.

| | Named Executive Officer | | | 2021 Base Salary ($) | | | Salary Increase as a Percentage of Prior Base Salary | | | 2022 Base Salary ($) | | | Rationale for Increase | | |||||||||

| | Shashank Patel | | | | | 465,000 | | | | | | 7.5% | | | | | $ | 500,000 | | | | Merit & Market Adjustment | |

| | Elie A. Melhem | | | | | 437,000 | | | | | | 3.5% | | | | | | 452,300 | | | | Merit | |

| | Kenneth R. Lepage | | | | | 430,000 | | | | | | 3.5% | | | | | | 445,000 | | | | Merit | |

| | | | | | | | | | | |

| Named Executive Officer | 2019 Base Salary | Merit Increase as a Percentage of Prior Base Salary | Approved 2020 Base Salary | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

Shashank Patel | $ | 416,000 | | 8.2 | % | $ | 450,000 | |||

Munish Nanda | $ | 512,000 | 3.5 | % | $ | 530,000 | ||||

Elie A. Melhem | $ | 425,500 | | 2.8 | % | $ | 437,000 | |||

Kenneth R. Lepage | $ | 413,000 | 3.3 | % | $ | 427,000 | ||||

| | | | | | | | | | | |

In February 2020,2022, the Compensation Committee conducted a separate review of our Chief Executive Officer'sOfficer’s performance and base salary in conjunction with the other independent members of the Board. The independent members of the Board reviewed Mr. Pagano'sPagano’s performance against his established goals for 20192021 and input from Pearl Meyer with respect to the competitiveness of Mr. Pagano'sPagano’s base salary relative to the Company'sCompany’s executive compensation peer group. Based on this review and the Board'sBoard’s assessment that Mr. Pagano had achieved his 20192021 goals, including executing on driving innovation through new products and solutions as well as other global growth initiatives, launchingpromoting sustainability as a key part of the smartCompany’s strategy, and connected solutions strategy, driving productivity and supply chain savings initiatives, deploying initiatives to address the top focus areas from the last global employee survey, and exceeding the 2019 financial plan, the Compensation Committee approved a 3.6%3.5% merit-based increase in Mr. Pagano'sPagano’s base salary from $930,600$975,000 to $965,000$1,009,100, effective as of April 1, 2020.

In March 2020,2022.

connection with his hire. In additionapproving Mr. Dhawan’s base salary, the Compensation Committee reviewed compensation survey data and Mr. Dhawan’s compensation arrangements with his previous employer and considered the most recent competitive compensation assessment data with respect to the suspensionCompany’s compensation peer group. The Committee also sought the advice and guidance of merit increases, in late April 2020, at the request of our Chief Executive Officer, the Board of Directors approved a 25% reduction in the base salary of our Chief Executive Officer and a 15% reduction in the base salaries of our other named executive officers for a five-month period from May 1, 2020 through September 30, 2020.

Pearl Meyer, its independent compensation consultant.

salary rate remained unchangeddays he was employed by the Company during the year. The Compensation Committee also approved a one-time cash bonus for Mr. Dhawan in the amount of $175,000 which was paid on March 15, 2023 and which was intended to replace the prorated amount of Mr. Dhawan’s 2022 bonus that he would have been eligible to receive from 2019.his former employer. The 20202022 target bonus amounts for our named executive officers were set as follows:

| | | | | Target as a Percent of Salary | | | Target in Dollars | | ||||||

| | Robert J. Pagano, Jr. | | | | | 110% | | | | | $ | 1,110,010 | | |

| | Shashank Patel | | | | | 70% | | | | | $ | 350,000 | | |

| | Andre Dhawan | | | | | 65% | | | | | $ | 135,928* | | |

| | Elie A. Melhem | | | | | 55% | | | | | $ | 248,765 | | |

| | Kenneth R. Lepage | | | | | 60% | | | | | $ | 267,000 | | |

| | | | | | | | |

| | Target as a Percent of Salary | Target in Dollars | |||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

Robert J. Pagano, Jr. | | 100 | % | $ | 930,600 | ||

Shashank Patel | 65 | % | $ | 270,400 | |||

Munish Nanda | | 65 | % | $ | 332,800 | ||

Elie A. Melhem | 55 | % | $ | 233,750 | |||

Kenneth R. Lepage | | 60 | % | $ | 247,800 | ||

| | | | | | | | |

| | ||||||||

| | | |||||||

| Bonus Payout as a % of Target | ||||||||

|---|---|---|---|---|---|---|---|---|

| | ||||||||

| | |||||||

| ||||||||

| ||||||||

| ||||||||

| | | | | 200% | | | ||

| | Target | | | | | 100% | | |

| | Threshold | | | | | 50% | | |

| | Below Threshold | | | | | 0% | | |

Under our Executive Officer Incentive Bonus Plan, the Compensation Committee may in its sole discretion, make certain adjustments to the performance objectives. Such adjustments may include but are not limited to: (i) a change in accounting principle, (ii) financing activities, (iii) expenses for restructuring or productivity initiatives, (iv) other non-operating items, (v) acquisitions or dispositions, (vi) the business operations of an entity acquired by the Company during the performance period, (vii) discontinued operations, (viii) stock dividend, split, combination or exchange of stock, (ix) unusual or extraordinary events, transactions or developments, (x) amortization of intangible assets, (xi) other significant income or expense outside the Company'sCompany’s core on-going business activities, (xii) other nonrecurring items, (xiii) goodwill or intangible writeoffs, or (xiv) changes in applicable law.

| | Named Executive Officer | | | Consolidated Net Sales | | | Consolidated Adjusted Net Income | | | Consolidated Free Cash Flow* | | | APMEA Net Trade Sales | | | APMEA Adjusted Operating Income* | | | APMEA Free Cash Flow* | | | Individual Component | | |||||||||||||||||||||

| | Robert J. Pagano, Jr. | | | | | 25% | | | | | | 40% | | | | | | 25% | | | | | | — | | | | | | — | | | | | | — | | | | | | 10% | | |

| | Shashank Patel | | | | | 25% | | | | | | 40% | | | | | | 25% | | | | | | — | | | | | | — | | | | | | — | | | | | | 10% | | |

| | Andre Dhawan | | | | | 25% | | | | | | 40% | | | | | | 25% | | | | | | — | | | | | | — | | | | | | — | | | | | | 10% | | |

| | Elie A. Melhem | | | | | 6% | | | | | | 12% | | | | | | 9% | | | | | | 19% | | | | | | 28% | | | | | | 16% | | | | | | 10% | | |

| | Kenneth R. Lepage | | | | | 25% | | | | | | 40% | | | | | | 25% | | | | | | — | | | | | | — | | | | | | — | | | | | | 10% | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Named Executive Officer | Consolidated Trade Sales | Consolidated Net Income | Consolidated Free Cash Flow* | APMEA Segment Trade Sales | APMEA Segment Operating Earnings | APMEA Segment Free Cash Flow | Individual Component | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | | | | | | | | | |

Robert J. Pagano, Jr. | | 25.0 | % | | 40.0 | % | | 25.0 | % | | — | | — | | — | | 10.0 | % | ||||

Shashank Patel | 25.0 | % | 40.0 | % | 25.0 | % | — | — | — | 10.0 | % | |||||||||||

Munish Nanda | | 25.0 | % | | 40.0 | % | | 25.0 | % | | — | | — | | — | | 10.0 | % | ||||

Elie A. Melhem | 6.0 | % | 12.0 | % | 9.0 | % | 19.0 | % | 28.0 | % | 16.0 | % | 10.0 | % | ||||||||

Kenneth R. Lepage | | 25.0 | % | | 40.0 | % | | 25.0 | % | | — | | — | | — | | 10.0 | % | ||||

| | | | | | | | | | | | | | | | | | | | | | | |

*- A reconciliation of net income to adjusted net income, net cash provided by operating activities to free cash flow, and operating income to adjusted operating income is included in Item 7 of our Annual Report on Form 10-K filed with the SEC on February

18, 2021.21, 2023. APMEA segment free cash flow means free cash flow attributable to the APMEA reporting segment, and APMEA adjusted operating income means adjusted operating income attributable to the APMEA reporting segment.

Soon after the Compensation Committee approved the 2020 bonus targets and objectives for our named executive officers, the COVID-19 pandemic began to significantly impact economic activity in the Americas and Europe, where we had more than 95% of our total global sales in 2020. At the beginning of 2020, we did not yet appreciate the full scope and depth of the impact the COVID-19 pandemic would have on the global economy and management had not taken into account the impact from COVID-19 in our 2020 annual operating plan. Accordingly, the 2020 bonus targets and objectives the Compensation Committee approved for our named executive officers in early February 2020 also did not take into account the impact from COVID-19. As the year progressed, it became apparent that the economic impact from the COVID-19 pandemic would make the 2020 sales and net income targets set under the Executive Officer Incentive Bonus Plan almost entirely unachievable. In May and July 2020 the Compensation Committee met with management and Pearl Meyer to review and discuss options for dealing with the impact of COVID-19 on 2020 incentive compensation. In reviewing the available options, the Compensation Committee stressed the need to balance appropriately rewarding management for their intensive efforts in managing through the COVID-19 crisis and keeping the Company operating safely and efficiently with properly

recognizing that the Company had suffered a financial setback as a result of the pandemic. At that time, the Compensation Committee agreed in principle that a fair but conservative method for addressing the impact of COVID-19 would be to adjust the Company's 2020 sales and net income or operating earnings results by 50% of the estimated impact that COVID-19 had on 2020 results, including recognition of the aggressive cost reduction efforts undertaken by management. By adjusting results by only half of the estimated impact of COVID-19, the Compensation Committee believed it was striking a fair balance while incentivizing and rewarding participant efforts throughout 2020. For the remainder of the year, management tracked and kept the Board of Directors informed of the estimated impact that COVID-19 was having on the Company's financial results.

Our results for 20202022 as determined underin accordance with our Executive Officer Incentive Bonus Plan with respect to each financial performance measure for our Company as a whole and our APMEA segment and the adjustments made by the Compensation Committee to provide relief for 50% of the estimated impact of the COVID-19 pandemic on sales and net income or operating earnings, are set forth in the following table:

| | Financial Performance Measures | | | Financial Performance Targets (in millions) | | | 2022 Actual Results (in millions) | | | % of Bonus Objective Achieved* | | |||||||||||||||||||||

| | Threshold (50%) | | | Target (100%) | | | Maximum (200%) | | ||||||||||||||||||||||||

| | Consolidated Net Sales | | | | $ | 1,590 | | | | | $ | 1,871 | | | | | $ | 2,152 | | | | | $ | 1,980 | | | | | | 156% | | |

| | Consolidated Adjusted Net Income | | | | $ | 168 | | | | | $ | 198 | | | | | $ | 228 | | | | | $ | 241 | | | | | | 200% | | |

| | Consolidated Free Cash Flow | | | | $ | 148 | | | | | $ | 174 | | | | | $ | 209 | | | | | $ | 204 | | | | | | 186% | | |

| | APMEA Net Trade Sales | | | | $ | 75 | | | | | $ | 89 | | | | | $ | 102 | | | | | $ | 91 | | | | | | 166% | | |

| | APMEA Adjusted Operating Income | | | | $ | 11 | | | | | $ | 13 | | | | | $ | 15 | | | | | $ | 15 | | | | | | 200% | | |

| | APMEA Free Cash Flow | | | | $ | 7 | | | | | $ | 8 | | | | | $ | 10 | | | | | $ | 10 | | | | | | 200% | | |

| | | | | | | | | | | | | | | | | | | | |

| | Financial Performance Targets (in millions) | | 2020 Results Adjusted for 50% of Estimated Impact of COVID-19 | | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2020 Actual Results (in millions) | % of Bonus Objective Achieved | |||||||||||||||||

| Financial Performance Measures | Threshold (50%) | Target (100%) | Maximum (200%) | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | |

Consolidated Sales | $ | 1,479.7 | $ | 1,644.1 | $ | 1,808.5 | $ | 1,501.1 | $ | 1,570.4 | | 77.6 | % | ||||||

Consolidated Net Income | $ | 135.1 | $ | 150.1 | $ | 165.1 | $ | 133.9 | $ | 155.7 | 137.3 | % | |||||||

Consolidated Free Cash Flow | $ | 128.8 | $ | 151.6 | $ | 181.9 | $ | 196.4 | | — | | 200.0 | % | ||||||

APMEA Segment Trade Sales | $ | 64.0 | $ | 71.1 | $ | 78.2 | $ | 50.8 | $ | 58.9 | 0.0 | % | |||||||

APMEA Segment Operating Earnings | $ | 7.0 | $ | 7.7 | $ | 8.5 | $ | 7.5 | $ | 10.7 | | 200.0 | % | ||||||

APMEA Segment Free Cash Flow | $ | 5.9 | $ | 6.9 | $ | 8.3 | $ | 13.0 | — | 200.0 | % | ||||||||

| | | | | | | | | | | | | | | | | | | | |

| | Named Executive Officer | | | Financial Performance Measure | | | Weighting | | | 2022 Achievement | | | Weighted 2022 Achievement | | |||||||||

| | Robert J. Pagano, Jr. | | | Consolidated Net Sales | | | | | 25% | | | | | | 156% | | | | | | 39% | | |

| | Shashank Patel | | | Consolidated Adjusted Net Income | | | | | 40% | | | | | | 200% | | | | | | 80% | | |

| | Kenneth R. Lepage | | | Consolidated Free Cash Flow | | | | | 25% | | | | | | 186% | | | | | | 46% | | |

| | Andre Dhawan | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | 90% | | | | | | | | | | | | 165% | | |

| | Elie A. Melhem | | | Consolidated Net Sales | | | | | 6% | | | | | | 156% | | | | | | 9% | | |

| | | | | Consolidated Adjusted Net Income | | | | | 12% | | | | | | 200% | | | | | | 24% | | |

| | | | | Consolidated Free Cash Flow | | | | | 9% | | | | | | 186% | | | | | | 17% | | |

| | | | | APMEA Net Trade Sales | | | | | 19% | | | | | | 166% | | | | | | 32% | | |

| | | | | APMEA Adjusted Operating Income | | | | | 28% | | | | | | 200% | | | | | | 56% | | |

| | | | | APMEA Free Cash Flow | | | | | 16% | | | | | | 200% | | | | | | 32% | | |

| | | | | | | | | | 90% | | | | | | | | | | | | 170% | | |

| | | | | | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | |

| Named Executive Officer | Financial Performance Measure | Weighting | 2020 Achievement | Weighted 2020 Achievement | ||||||||

| | | | | | | | | | | | | |

Robert J. Pagano, Jr. | Consolidated Sales | | 25.0 | % | | 77.6 | % | | 19.4 | % | ||

Shashank Patel | Consolidated Net Income | | 40.0 | % | | 137.7 | % | | 55.1 | % | ||

Kenneth R. Lepage | Consolidated Free Cash Flow | | 25.0 | % | | 200.0 | % | | 50.0 | % | ||

Munish Nanda | | | | |||||||||

| | | | | | | | | | | | | |

| 90 | % | 124.5 | % | |||||||||

Elie A. Melhem | Consolidated Sales | | 6.0 | % | | 77.6 | % | | 4.7 | % | ||

| Consolidated Net Income | | 12.0 | % | | 137.7 | % | | 16.5 | % | ||

| Consolidated Free Cash Flow | | 9.0 | % | | 200.0 | % | | 18.0 | % | ||

| APMEA Trade Sales | | 19.0 | % | | 0.0 | % | | 0.0 | % | ||

| APMEA Operating Earnings | | 28.0 | % | | 200.0 | % | | 56.0 | % | ||

| APMEA Free Cash Flow | | 16.0 | % | | 200.0 | % | | 32.0 | % | ||

| | | | | | | | | | | | | |

| 90.0 | % | 127.2 | % | |||||||||

| | | | | | | | | | | | | |

The Compensation Committee reviewed with our Chief Executive Officer the performance of each of the other named executive officers with respect to their individual performance objectives. Based on this review and the recommendations of our Chief Executive Officer, the Compensation Committee determined that each of Messrs. Nanda, Patel, Melhem and Lepage had achieved higher than the target level of performance with respect to his individual performance objectives. In recognition of their strong performance, the Compensation Committee approved a 14%17% weighted achievement for the individual performance component of the incentive bonus award for each of Mr. Nanda, Mr. Patel and Mr. Lepage and an 11%13% for Mr. Melhem. Given that Mr. Dhawan was new in his position and had been with the Company for less than half of 2022, the Compensation Committee approved a 10% weighted achievement for Mr. Melhem.the individual component of his bonus award. The Compensation Committee separately reviewed the performance of Mr. Pagano with respect to his individual performance objectives and determined that Mr. Pagano had exceeded his objectives and that he had done an excellent job guidingdeveloping, deploying and executing on the Company through the COVID-19 crisis,Company’s strategic growth initiatives, awarding him a 15%17% weighted achievement for the individual performance component of the incentive bonus award.

| | Named Executive Officer | | | 2022 Target Bonus Awards as a Percentage of Base Salary | | | 2022 Target Bonus Awards | | | Financial Performance Measures Achievement (A) | | | Individual Performance Measures Achievement (B) | | | 2022 Bonus Awards as a Percentage of Target (A+B) | | | 2022 Actual Bonus Awards | | ||||||||||||||||||

| | Robert J. Pagano, Jr. | | | | | 110% | | | | | $ | 1,110,010 | | | | | | 165% | | | | | | 17% | | | | | | 182% | | | | | $ | 2,024,660 | | |

| | Shashank Patel | | | | | 70% | | | | | $ | 350,000 | | | | | | 165% | | | | | | 17% | | | | | | 182% | | | | | $ | 638,400 | | |

| | Andre Dhawan* | | | | | 65% | | | | | $ | 135,928 | | | | | | 165% | | | | | | 10% | | | | | | 175% | | | | | $ | 238,660 | | |

| | Elie A. Melhem | | | | | 55% | | | | | $ | 248,765 | | | | | | 170% | | | | | | 13% | | | | | | 182% | | | | | $ | 453,750 | | |

| | Kenneth R. Lepage | | | | | 60% | | | | | $ | 267,000 | | | | | | 165% | | | | | | 17% | | | | | | 182% | | | | | $ | 487,010 | | |

| | | | | | | | | | | | | | | | | | | | |

| Named Executive Officer | 2020 Target Bonus Awards as a Percentage of Base Salary | 2020 Target Bonus Awards | Financial Performance Measures Achievement (A) | Individual Performance Measures Achievement (B) | 2020 Bonus Awards as a Percentage of Target (A+B) | 2020 Actual Bonus Awards | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | | | | | | |

Robert J. Pagano, Jr. | | 100 | % | $ | 930,600 | | 124.5 | % | | 15.0 | % | | 139.5 | % | $ | 1,298,187 | |||

Shashank Patel | 65 | % | $ | 270,400 | 124.5 | % | 14.0 | % | 138.5 | % | $ | 374,450 | |||||||

Munish Nanda | | 65 | % | $ | 332,800 | | 124.5 | % | | 14.0 | % | | 138.5 | % | $ | 460,861 | |||

Elie A. Melhem | 55 | % | $ | 233,750 | 127.2 | % | 11.0 | % | 138.2 | % | $ | 322,996 | |||||||

Kenneth R. Lepage | | 60 | % | $ | 247,800 | | 124.5 | % | | 14.0 | % | | 138.5 | % | $ | 343,153 | |||

| | | | | | | | | | | | | | | | | | | | |

In approvingAs described above, Mr. Dhawan’s employment offer provided him with a one-time hiring bonus of $175,000 in addition to a prorated performance bonus earned under the 2020 bonus awards, the Compensation Committee also considered our relative performance against our executive compensation peer group, concluding that the Company performed at or above the 50th percentileExecutive Officer Incentive Bonus Plan for 2022 based on revenue and profit related growth measures for the periods publicly reported, and further was positioned above the 75th percentile on both 1- and 3-year total shareholder returns. The Compensation Committee believed these relative performance results supported a payout above the target incentive award level consistenthis partial year of employment with actual achievement of the performance goals.

us. Management Stock Purchase Plan based on recommendations made by executive management. Participants were entitled to purchase restricted stock units under the Management Stock Purchase Plan at a discount of 20% from the closing sale price of our class A common stock on 2022. Robert J. Pagano, Jr. Shashank Patel Munish Nanda Elie Melhem Kenneth R. Lepage each level of achievement relative to specified performance goals. The performance goals include a combination of the In connection with Mr. Dhawan’s commencement of employment with us, we agreed to pay customary out-of-pocket expenses incurred by him in connection with his relocation. amount in cash equal to (i) 24 months of premiums the named executive officer would have to pay for COBRA medical coverage, and (ii) two times the sum of the named executive Mr. Melhem is the only named executive officer who has qualified for retirement vesting. five or more years were in compliance with our stock ownership guidelines. For information on the Robert J. Pagano, Jr. Chief Executive Officer and President Shashank Patel Chief Financial Officer Munish Nanda President, Americas & Europe Elie A. Melhem President, Asia-Pacific, the Middle East & Africa Kenneth R. Lepage General Counsel, Chief Human Resources Officer & Secretary The risk-free interest rate is based on the U.S. treasury yield curve at the time of grant for the expected life of the restricted stock unit. The expected life, which is defined as the estimated period of time outstanding, of the restricted stock unit and the volatility were calculated using historical data. The expected dividend yield is our best estimate of the expected future dividend yield. Based on these assumptions, the weighted average grant date fair value of the discount on a restricted stock unit purchased on March 15, Robert J. Pagano, Jr. Shashank Patel Munish Nanda Elie A. Melhem Kenneth R. Lepage stock units granted to each such officer during Robert J. Pagano, Jr. Shashank Patel Munish Nanda Elie A. Melhem Kenneth R. Lepage Robert J. Pagano, Jr. Shashank Patel Munish Nanda Elie A. Melhem Kenneth R. Lepage Car allowance Financial planning allowance (a) Company contribution to 401(k) plan Supplemental disability insurance premium Executive physical Payments related to expatriate assignment (b) Total All Other Compensation Robert J. Pagano, Jr. Shashank Patel Munish Nanda Elie A. Melhem Kenneth R. Lepage Robert J. Pagano, Jr. Shashank Patel Munish Nanda Elie A. Melhem Kenneth R. Lepage Robert J. Pagano, Jr. Shashank Patel Munish Nanda Elie A. Melhem Kenneth R. Lepage Robert J. Pagano, Jr. Shashank Patel Munish Nanda Elie A. Melhem Kenneth R. Lepage Robert J. Pagano, Jr. Shashank Patel Munish Nanda Elie A. Melhem Kenneth R. Lepage In addition, under the Executive Severance Plan, if a participant is involuntarily terminated without cause or resigns for good reason (as defined in the Executive Severance Plan) within 24 months following a change in control of the Company, or is involuntarily terminated without cause in the six months prior to such change in control, such participant would be entitled to full accelerated vesting and, as applicable, exercisability of unvested equity or equity-based awards of the Company that are not subject to performance vesting conditions and, for awards that are subject to performance vesting conditions, accelerated vesting and, as applicable, exercisability at the greater of target or the level that would apply based on actual performance calculated as if the final day of the 10 years of service and who meets certain other requirements, including non-competition and non-solicitation requirements, will be allowed to continue to vest in his or her deferred stock awards for the duration of the vesting periods and will be entitled to receive a pro rata portion of his or her performance stock units based on the period of service elapsed during the performance period and the actual number of shares earned. benefit, as described in more detail in the Nonqualified Deferred Compensation Table above. units and restricted stock units that would vest and the value of such acceleration in the event of certain terminations or a change in control as of December 31, Robert J. Pagano, Jr. ➢ Change in Control: ➢ Termination due to Death or Disability: ➢ Termination due to Retirement: Shashank Patel ➢ Change in Control: ➢ Termination due to Death or Disability: ➢ Termination due to Retirement: Munish Nanda ➢ Change in Control: ➢ Termination due to Death or Disability: ➢ Termination due to Retirement: Elie A. Melhem ➢ Change in Control: ➢ Termination due to Death or Disability: ➢ Termination due to Retirement: Kenneth R. Lepage ➢ Change in Control: ➢ Termination due to Death or Disability: ➢ Termination due to Retirement: $7,076,495. We believe our compensation program and policies described in this proxy statement are aligned with stockholder interests and are worthy of stockholder support. Accordingly, we ask our stockholders to approve the following resolution at the Annual Meeting: submit the appointment of the independent registered public accounting firm to the stockholders for their ratification. The Audit Committee appointed KPMG LLP as our independent registered public accounting firm for time to time, based on subsequent determinations. Audit Fees: Audit-Related Fees: Tax Fees: All Other Fees: Total: Audit fees primarily include fees we paid KPMG for professional services for the audit of our annual financial statements included in our annual report on Form 10-K, review of financial statements included in our quarterly reports on Form 10-Q, and for services that are normally provided in connection with statutory and regulatory filings or engagements, such as consents. Audit fees for receiving multiple copies and would like to receive only one copy 20202022 by granting performance stock units and deferred stock awards covering shares of class A common stockFebruary 16, 2021March 15, 2023 using up to 50% of their pre-tax 20202022 performance bonus. The restricted stock units vest in three equal annual installmentsone-third each year beginning one year afteron the first anniversary of the date of grant. In addition, participants in the Management Stock Purchase Plan may elect to defer settlement of vested restricted stock units to a specified future date. For 2020,2022, Messrs. Pagano, Patel, Melhem and Lepage each elected to contribute 50% of his annual performance bonus to the purchase of restricted stock units under the Management Stock Purchase Plan. Mr. NandaDhawan and Mr. Patel did not participate in the Management Stock Purchase Plan in 2020.2020,2022, we granted performance stock units and deferred stock awards to our executive officers, with each type of award accounting for 50% of the targeted value of long-term equity incentive awards for executive officers. The Compensation Committee believes that the use of performance stock unit awards and deferred stock awards in combination provides strong shareholder alignment, retention value, and the opportunity to leverage the value of awards up and down consistent with the Company'sCompany’s stock price performance as well as Company performance over the long term.Committee'sCommittee’s assessment of the appropriate mix of fixed versus variable and short-term versus long-term incentives. The Compensation Committee also considered each named executive officer'sofficer’s role, potential long-term contribution, performance, experience and skills. Based on its analysis, the Compensation Committee determined that the performance stock units and deferred stock awarded to the Company'sCompany’s Chief Executive Officer generally should have a targeted total value of approximately three and one half times his annual base salary and the annual equity grant to each of our other named executive officers generally should have a targeted total grant date fair value of approximately one-and-a-half times his annual base salary. These are general guidelines and the Compensation Committee may change the value of awards based on an executive’s performance or other relevant factors. The following table shows the values used to determine the number of shares underlying the annual deferred stock awards and the target performance stock unit awards granted to our named executive officers in March 2020.2022. In determining the number of shares underlying the awards granted to each named executive officer in 2022, we used a 30-day trailing average stock price. This marked a change from our prior practice of using a 90-day trailing average stock price to determine the number of shares to award. In March 2022, the Compensation Committee reevaluated its practice of using a 90-day trailing average stock price to determine the number of shares to be granted to participants in our equity incentive program given the three-monthsteep drop in the Company’s stock price following the invasion of Ukraine and the resulting disparity between the 90-day trailing average stock price and the closingCompany’s stock price as of the last trading day prior to the date of thein March 2022. The Compensation Committee meeting.consulted with Pearl Meyer and management and decided that it should change its practice for determining the number of shares being awarded to use a 30-day trailing average stock price in order to align the Committee’s practice with best practices and avoid significant Named Executive Officer Performance Stock

Unit Awards

(Target Award) Deferred Stock

Awards Total Robert J. Pagano, Jr. $ 1,765,925 $ 1,765,925 $ 3,531,850 Shashank Patel $ 375,000 $ 375,000 $ 750,000 Andre Dhawan* — — — Elie Melhem $ 339,225 $ 339,225 $ 678,450 Kenneth R. Lepage $ 333,750 $ 333,750 $ 667,500 Named Executive Officer Performance Stock

Unit Awards

(Target Award) Deferred Stock